Filing business tax returns is complex due to ever-changing laws, regulations, and new forms. Rely on our tax experts for dependable support in preparing, reviewing, and filing your required documents.

Payroll Tax Services

Take the stress out of taxes.

Tax Services Overview

Loved by Employers and Employees

Frequently Asked Questions

At the federal level, the main payroll taxes organizations see are for Social Security, Medicare, and Unemployment. While federal income tax is paid just by employees, organizations do have to withhold and deposit the funds to pay this tax on each employee’s behalf, as well as file returns for these deposits every quarter or year. Medicare taxes don’t have a wage base limit, but they do have an Additional Medicare Tax for wages above certain amounts.

In general, tax preparation fees are considered an “ordinary and necessary” expense for business owners and are deductible on Schedules C, F, and E.

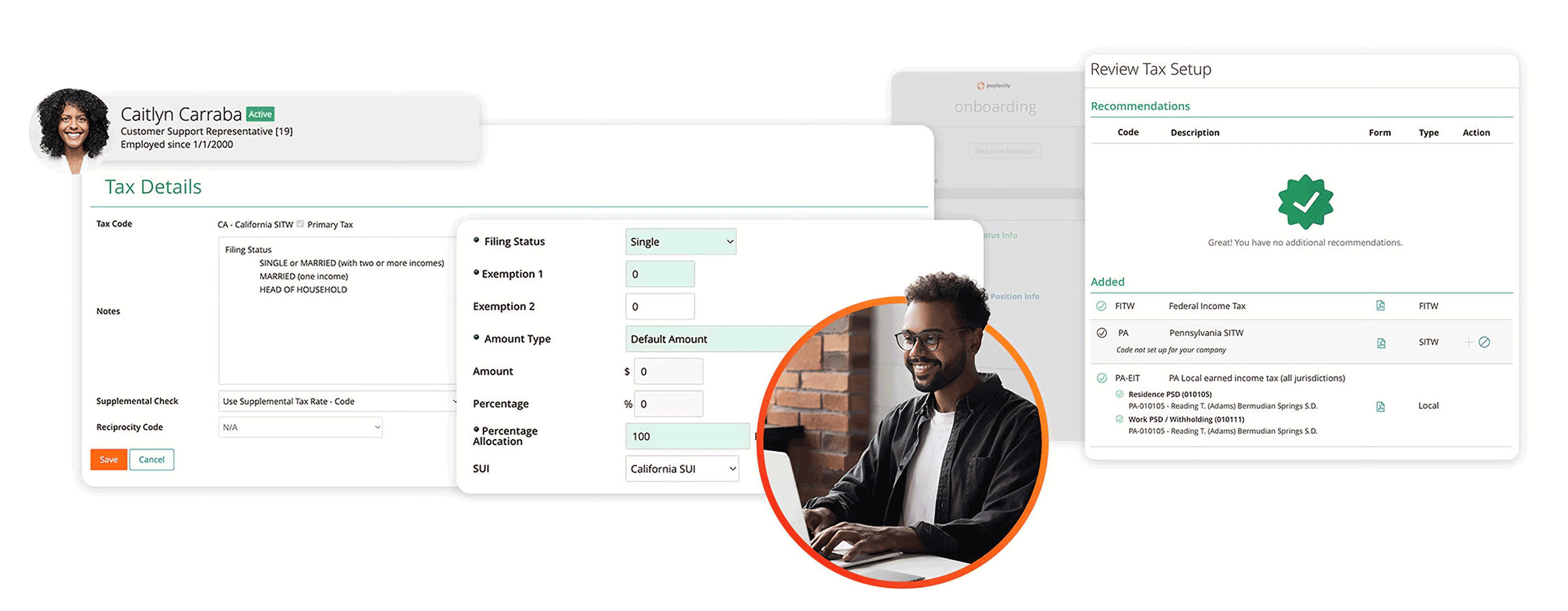

Yes, our tax preparation services experts will accurately prepare, review, and file the necessary documents for you. We're a Registered Reporting Agent with the IRS in all 50 states, Puerto Rico, the Virgin Islands, and Guam. We help you prepare and file:

- 940 federal unemployment returns and 941 quarterly returns

- Federal and state unemployment tax returns

- State and local withholding tax returns

- State and local annual reconciliation

- All W-2s and file with the Social Security Administration

We can also provide and file 1099-MISC forms (employee and employer copies) and give you quarterly and year-end reporting through our dashboards so you can visualize year-end tasks. Save time and get the support you need to put the confidence back into online tax filing.