Tip compliance refers to the rules and regulations that employers must follow regarding the reporting and payment of payroll taxes on tips that employees receive. The employee agrees to report tips at a set rate, and the employer reports these tips to the IRS, either through Form 8027 or via the employee’s W-2 form.

The IRS provides guidance on tip reporting and recordkeeping with further information.

How to reduce turnover in the restaurant and hospitality industry?

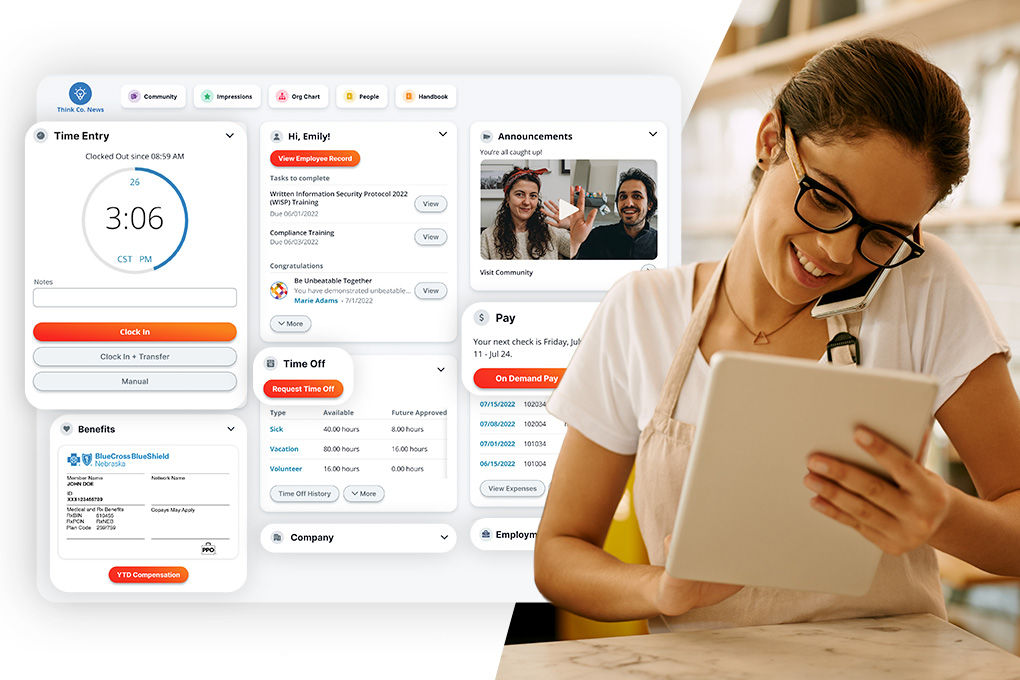

Businesses in the restaurant and hospitality industry can reduce turnover by creating a company culture of engagement. Engaged employees are happier, more loyal, and more productive than their disengaged counterparts — meaning higher profitability for your organization. By creating connections between colleagues and investing in your employees, you can build a workplace that will win and keep top talent.